Across the country the rental market is a consistent story of high demand and commensurately high rents as home buyers forced out of the market compete for accommodation. Greater Perth in particular has been forecast to continue sales value growth and rental vacancies are at a national low. For some time the property investment profile has seemingly favoured detached dwellings i.e. houses, but recently there have been signs of this is changing.

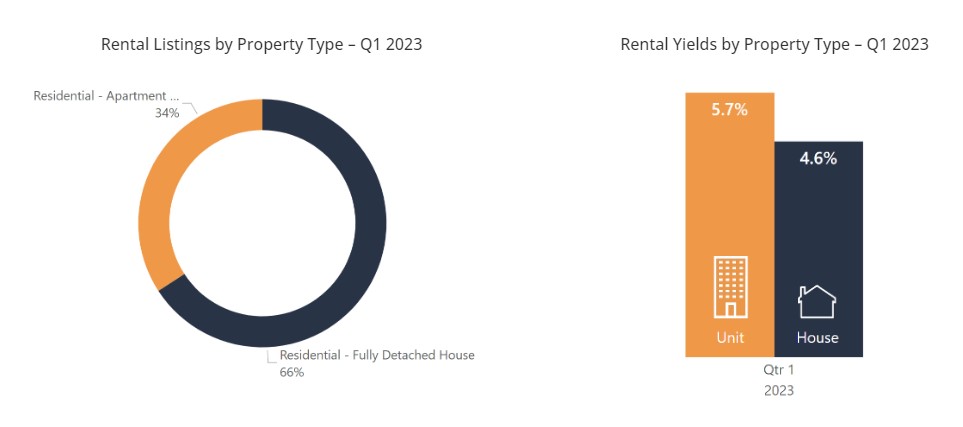

Looking at the past quarter, Q1 2023, using exclusive REIP rental listing data, shows 2/3rd houses vs 1/3rd apartments. This clearly reflects the mix of housing stock as much as demand or renter preferences. Yet gross yields based on current values indicates 4.6% on houses but an even better 5.7% on apartments.

However, Western Australia also recorded the world’s longest border closure during the COVID-19 years spanning 697 days between April 2020 to March 2022. During this time the demand for temporary accommodation from students and those employed in the mining industry obviously fell away along with demand for apartments and this is reflected in the steady decline in numbers of apartments purchased for investment over this period. However, the most recent quarter shows a lift in investment apartments along with the return of international students coupled with the strength of the mining sector which contributes to a significant portion of the temporary population in Perth.

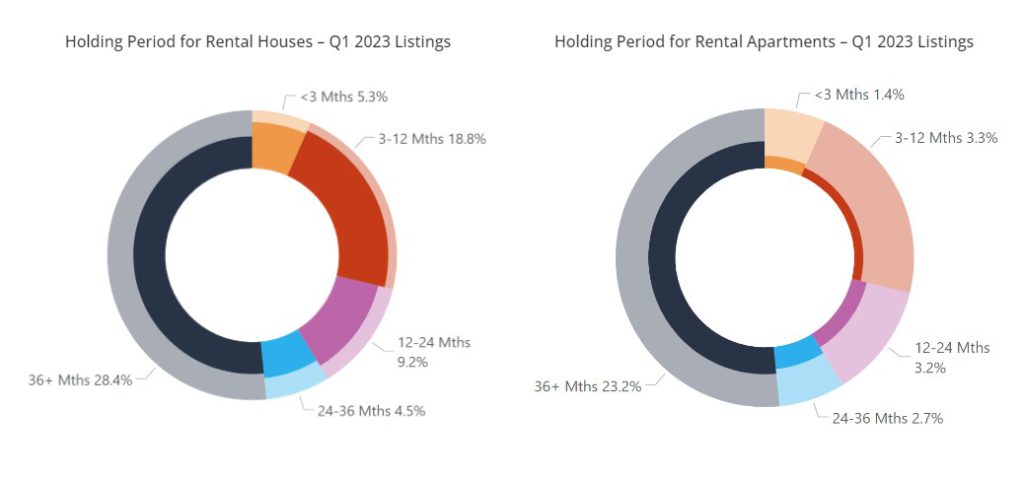

Analysis of the holding periods shows half of the rental properties in Q1 2023 listings were purchased over three years ago before the COVID-19 pandemic and border closures. Just under 20% were purchased during the two years of lockdown due to low demand for rental properties despite low interest rates. Yet in the past twelve months the number of investors appears to have increased 1.5x with nearly 30% of the rental listings purchased amidst a shortage of new housing stock forcing new home buyers to resort to renting again and fueling the increasing rents.

Separating by property type reveals the preference amongst investors for houses grew appreciably during the past three years but signs are in Q1 2023 that this may have peaked with the proportion of houses purchased for investment dropping for the first time. Conversely the market for rental apartments is now more attractive due to its lower entry price in the current high mortgage rate environment. This is likely to continue the momentum driving favourable rental returns overall but particularly in the apartment market for the foreseeable future. Q1 2023 saw the proportion of apartments purchased for investment rise for the first time since the pandemic.