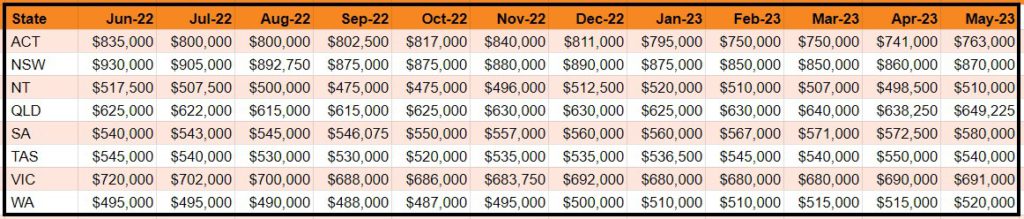

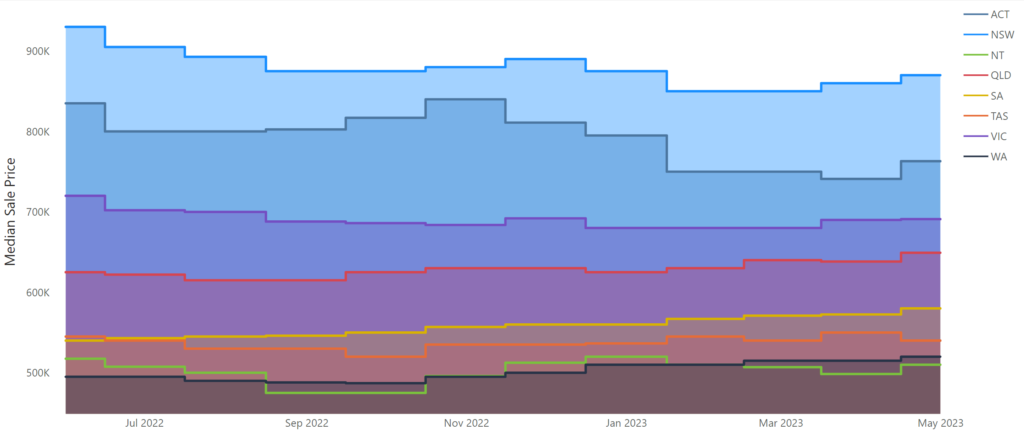

Sales trends are showing clear signs of recovery across the board despite continued cash rate increases with median prices up in the past month for all states (aside from TAS which is still showing a long-term growth trend regardless). Nationally, May was up 1.17% from April with ACT well ahead at 3.0% and NSW representing the weighted national average of 1.2%. Queensland also continued to be slightly ahead at 1.8% up on previous period.

QLD, SA, and WA median sales prices were up ~5% on this time last year with TAS and NT approaching parity. ACT, NSW and VIC are yet to fully recover however, they also exhibited some of the largest gains during the preceding boom so have the most ground to retrace.

REIP – Median Sales Prices Past 12 Months

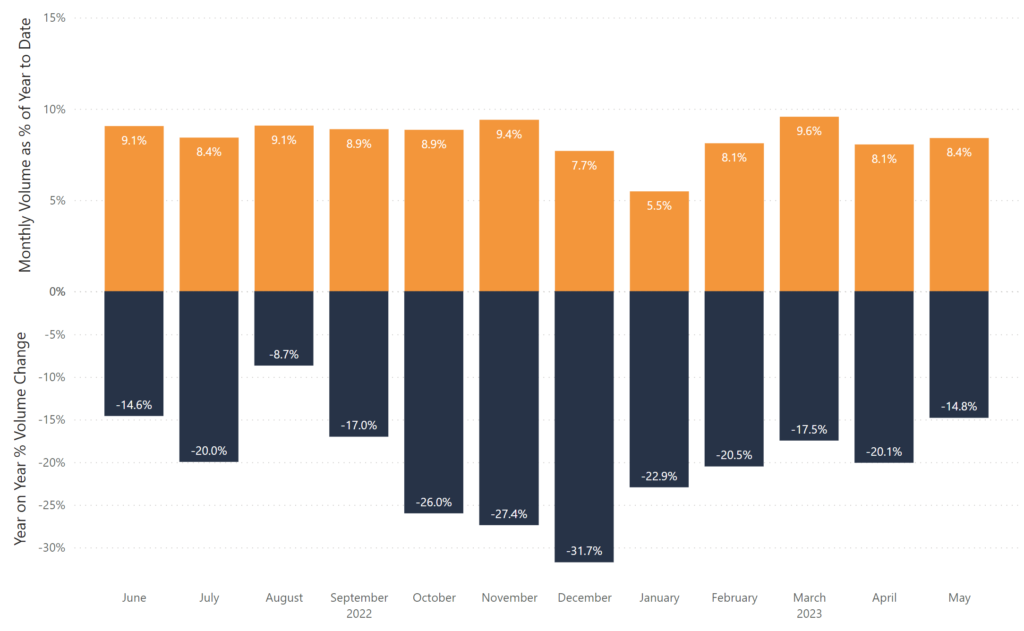

Volumes wise, May performed better than expected improving on April contrary to the usual seasonal trend downwards (the proportion of the annual volume each month represents is shown below). Whilst volumes remain down when comparing year on year, the deficit has been contracting since December and May closed only 14.8% down on the previous year.

REIP – Volume Trends Past 12 Months

Despite the continued pressures on home loan serviceability amid low consumer confidence, the market continues to recover both in price and volumes. The traditional drivers of housing stock shortage, coupled with immigration growth, mean potential headwinds from the rate increase early this month might not go unnoticed but are not anticipated to stem the overall trend.