With 2022 and the traditionally quiet Christmas/New Years holiday season behind us, a look back shows whilst nationally the residential market has steadily weakened, both South Australia (SA) and Western Australia (WA) continued to buck the trend with comparatively strong performance in median sales price and in the case of WA, sales volumes also. However, they are not immune to the market headwinds and both states are showing signs of coming off the peak.

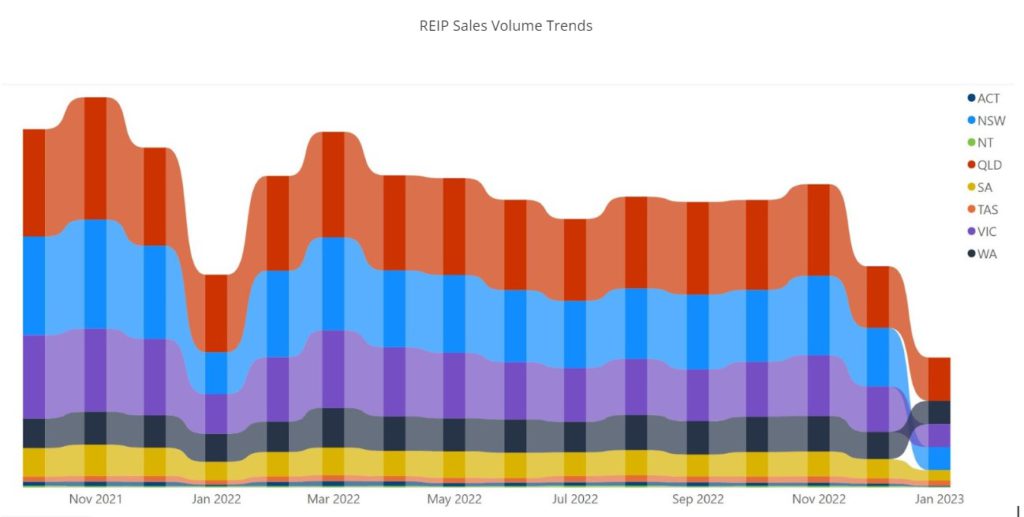

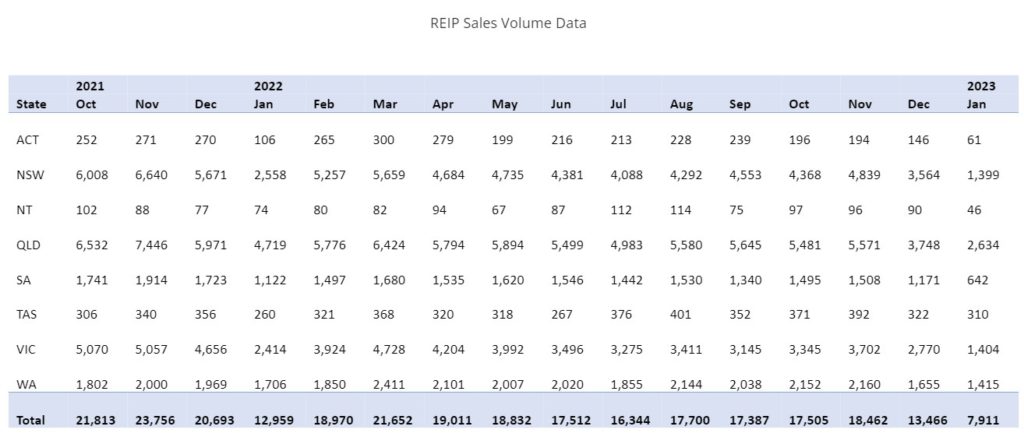

According to Valocity data, comparing Quarter Four 2022 to the same period a year ago shows a 20-30% decrease in sales volume across the largest states except for WA which actually grew 3%.

January’s traditionally low volumes aren’t necessarily representative for the long run but it was still notable to see WA leap to number two in volume ranking and conversely New South Wales (NSW) drop to fourth reflecting significantly lower sales activity in the largest market.

Queensland (QLD) peaked later than the NSW and VIC however, the signs are that it has plateaued for now. Tasmania (TAS) and Northern Territories (NT) were the only other states alongside WA to post year on year volume gains between 6-8% – however this was on comparatively low volumes overall.

Reserve Bank Australia (RBA) hikes since May 2022 are reflected in the subsequent volumes as loan serviceability pulled demand down and listings volume contracted in response.

The bright spot on this horizon was WA which countered these headwinds by launching a series of migration initiatives through 2022-2023 aimed at attracting skilled workers from both overseas and interstate as well as students. This was supported by strong employment prospects with an unemployment rate hovering around only 3% – the lowest of all the States, and employment rising by 70,000 positions which was the highest across the nation. This rise in employment has been entirely driven by full-time work, with full-time employment up 7.5 per cent in annual terms, the fastest growth on record.

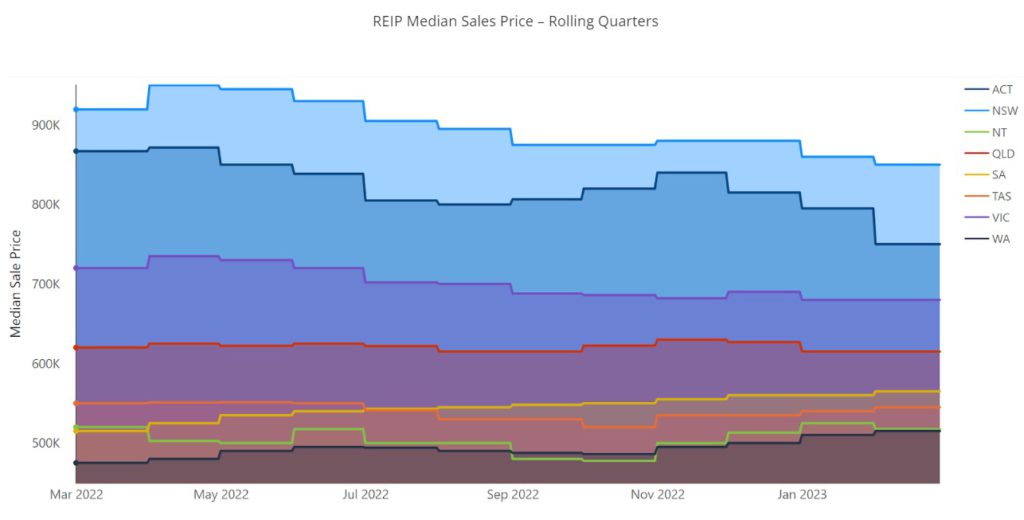

Median house prices also peaked during 2022 for the largest states but NSW, ACT and VIC have since rolled off sharply with NSW down 8%, ACT is down 13.5% and VIC is down 4.6% when comparing the current quarter with the same time last year, though the ACT posted some of the largest gains of any state in the past year hence the magnitude of correction may not be unexpected.

QLD, NT, and TAS have all returned to the levels this time last year negating the gains during 2022. But SA and WA have shone throughout 2022 with SA in particular posting month on month gains finishing 5.8% higher than previous year and WA settling 4.6% up.

Like WA, SA has strong job prospects, low unemployment, and the lowest rental vacancy rates among the capital cities. With comparatively affordable housing these markets remain attractive to homeowners and investors alike.

Looking ahead to the next quarter post holidays will better show whether this is a turning point for the market; however, positive signs include the return to pre-COVID conditions with rising immigration, coupled with tightened housing stock and a healthy rental market.