When the team at Lendi Group shared with me their vision to transform the way Australians search for property, I knew immediately this wasn’t just another tech integration – it was a genuine opportunity to reimagine how property data could empower people.

Most of you will already know that at REIP, we’re on a mission to support agents and agencies by connecting them to real, scalable opportunities – and this partnership does exactly that. By feeding live listings into Aussie’s rapidly growing property search platform, we’re ensuring our members’ listings are seen by serious, finance-ready buyers.

No vendor-paid advertising. No extra fees. Just real visibility, in front of people who are actively moving through the property journey.

But this initiative isn’t about replacing the traditional agent-buyer relationship – it’s about enhancing it. By collaborating with Lendi, we’re giving agents a new channel to showcase listings while giving consumers access to richer, more relevant data at the start of their property journey.

What excites me most is the bigger picture. This is about creating a smarter, more connected ecosystem – where brokers, agents, technology, and data work together to serve the customer better. It’s about putting industry-owned data to work in ways that genuinely benefit both professionals and the people they serve.

And the best part? This is just the beginning. You can read the press coverage here.

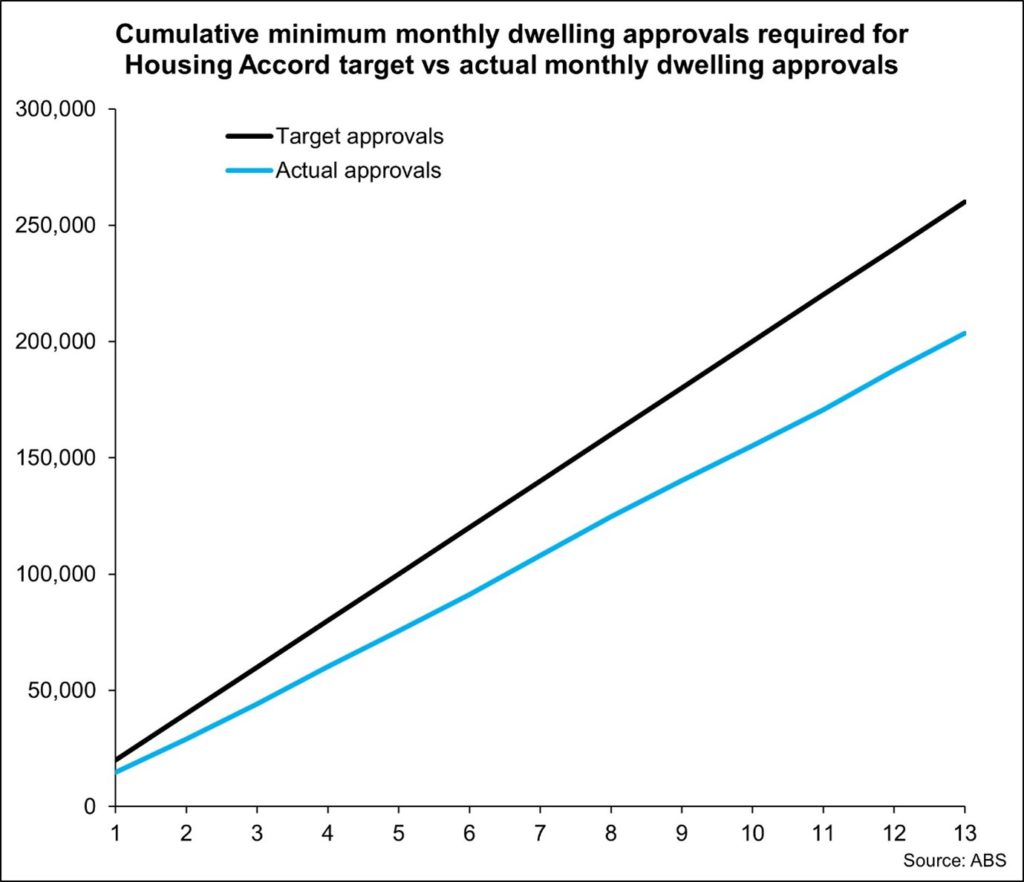

The Housing Accord (a federal budget target) aims to deliver 1.2 million new homes between July 2024 and June 2029, that’s around 20,000 approvals per month for five years. Given the target has never been achieved before, and a minimum of 1.2 million homes need to be sought for this to be achieved, it is going to be a challenge, and perhaps an unrealistic goal.

As the graph below shows, actual approvals consistently fall short of the minimum target:

- In the first 13 months, only 203,516 dwellings were approved – a shortfall of 56,484 against the target.

- Not a single month has seen 20,000 approvals; the closest was June 2025, with 17,185 approvals.

Even as interest rates ease and construction costs stabilise, the current pace is unlikely to meet the Accord’s goals. The type of housing also matters:

- Houses and medium-density developments are quicker and cheaper to build than high-density apartments.

- Most approvals are now skewed toward houses, which is a positive trend – but overall volumes are still insufficient.

The country urgently needs more housing delivered quickly, affordably, and in the types Australians want to live in. Current policy levers prioritise high-density inner-city housing, which:

- Takes longer to finance and construct

- Costs more than single houses or townhouses

- Delays supply reaching the market

A more effective approach would focus on greenfield and “missing middle” medium-density developments to speed delivery and reduce costs.

- Governments should also:

- Streamline approval processes

- Remove barriers slowing construction

- Encourage new housing supply rather than measures that push up demand for existing housing

While approvals are rising, without a laser focus on speed, cost, and the right housing types, the Housing Accord target remains out of reach.

Leaders in property and policy need to look beyond headline numbers and consider how housing delivery can be accelerated and made more affordable.

Stay in the know with the latest insights on Behind the Numbers – where we unpack the data shaping the Australian property market.

Until next time,

Stay connected.

![]()

Sadhana Smiles

CEO, Real Estate Industry Partners

I’m excited to welcome Dirk Miller as our new General Manager for Real Estate at REIP Nexus.

With over 15 years in the Real Estate and PropTech space, Dirk brings deep expertise in data utilisation and commercialisation, product innovation, and strategic growth. He has played a key role in driving acquisitions, scaling emerging PropTechs, and supporting established businesses to unlock new opportunities.

Dirk’s strategic mindset, leadership experience, and strong industry relationships will help REIP Nexus strengthen our real estate partnerships and deliver even greater value to our customers across Australia and New Zealand.

Let’s give him a warm welcome!

Thousands of properties. One platform. Made for real estate.

Start exploring the platform now – onboarding takes just minutes.

📞 +61 435 720 313

📧 Adam.Hinds@reipnexus.com.au

Your industry-backed and owned CMA and market insights tool helping you drive your real estate business with your data

Not an REIP member yet?

Join today for free and access exclusive discounts and offers from our partners.

Keep up to date with the latest industry news.

Subscribe to REIP Inside Real Estate.